Mining and aggregates companies today have access to business intelligence capable of revolutionizing their entire operations.

On one level, this intelligence can make many people’s jobs easier: Data helps companies meet their auditing and reporting obligations with much less fuss, and drone-mounted volumetric measurements tools keep people from having to walk dangerous piles for the sake of calculations.

But the opportunities go even further. We’ve seen first-hand how providing end-to-end data services helps mining and aggregates companies better respond to their customers’ demands and significantly grow their companies.

Below, we explore the three primary business cases for real-time data analytics in mining and aggregates, and how these uses create opportunities for those companies.

Handling Auditing and Regulatory Obligations

Let’s start with the most practical application of end-to-end data analysis: Industry regulations. As our Chief Drone Officer Andrew Maximow points out, in mining, aggregates and landfill industries, many of the companies are either publicly traded or subjected subject to rigorous third-party auditing requirements.

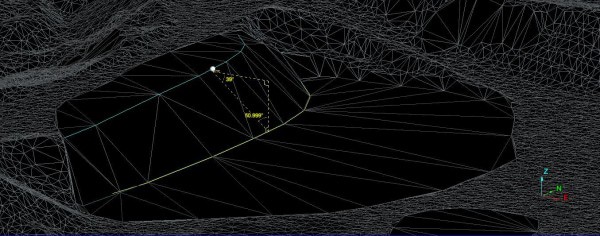

The problem is many services providers in that third-party auditing market only fly drones over an area and process the images. This leaves their clients on the hook for identifying stockpile inventories, loops, and toe and base elevations, Maximow says, which introduces “a high degree of variability in the volumetric calculations.”

What many of these companies actually need is an independent third-party solution for their stockpile inventories, a service that will remove any risks of imprecise measurements, verify the data and provide accurate data analysis.

An independent third-party solution can take this kind of work off of a company’s plate entirely and let them focus on their revenue-generating operations.

Speaking of which, this data can help company executives make smarter business decisions, as well, which in turn can bolster those revenue streams.

Anticipating and Forecasting Demand

When inventory measurements are done manually, the process is usually sufficiently labor-intensive that companies only perform those measurements once, maybe twice, per year. As a result, inventory reconciliation is less precise, and companies can lose tens of thousands of dollars each year to write-offs.

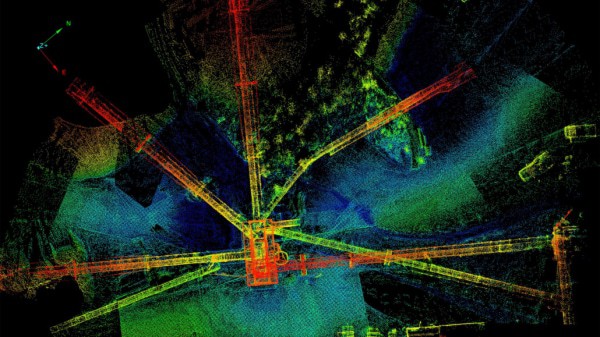

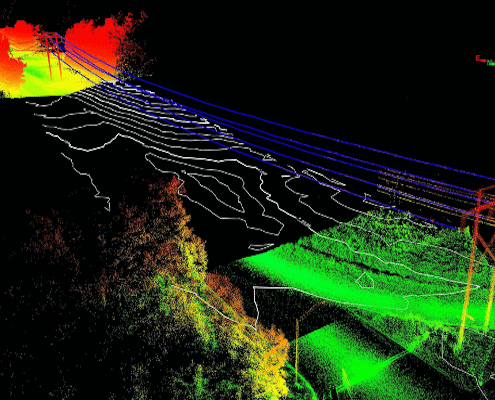

But when drone and mobile lidar tools pancake measurement times down to a matter of minutes? Measurements can be done monthly, if not more frequently, which gives management a near-real-time idea of inventories.

Not only does this minimize write-offs, but it also gives management a better idea of how much inventory gets moved each month. More precise numbers mean more precise demand forecasting.

Further, integrating analytics into other aspects of operations creates new efficiencies and opportunities — whether these capabilities are developed in-house or hired out to other service providers.

Eliminating Waste in Inventory Transport and Handling

Rick Delgado at SmartDataCollective notes that many mining companies leak revenue when transporting minerals from the pit to their destinations. “Much of the data for this transportation comes from the use of rail to move goods to the port,” he says. “Many of the deficiencies reported by the companies deals with the automated processes of loading rail cars.”

By implementing analytics solutions to the transport of minerals, companies can get visibility into where revenue might be leaking and plug those holes. Delgado cites Rio Tinto as one company that did this by employing algorithms that were able to load each rail car exactly to their capacities — not over, not under — which let the company measure how much product it was moving with pinpoint precision.

Analytics Help Forecast Demand Among Other Assets

It’s not just inventory and stockpiles that data analytics shine a light on. As McKinsey & Company points out, real-time intel gives mine owners and managers a view into where their equipment is at all times.

“This real-time insight gives new meaning to operations performance management, taking the conversation from one about monthly output to one that focuses on variability and compliance to plan,” McKinsey & Co. researchers write. “Furthermore, connecting this real-time feed to a central operating center not only makes possible a real-time response but also moves control to a more sophisticated decision-making capability at the center that can take actions to optimize operations across the whole supply chain, rather than local silos.”

Smart Technology Creates Smarter Ways of Doing Business

Take everything mentioned so far — smarter inventory data, smarter operations data — and walk it one level of abstraction forward. Now, we’re getting into technology that just a few years ago might have sounded like sci-fi, but today is becoming a reality in heavy industry.

A logical application of the Internet of Things is having all of the tools and assets at a worksite connected and able to share data with one another. Megan Smalley at Pit & Quarry explores this idea of a connected enterprise, particularly how these data-sharing capabilities empower people in charge of day-to-day tasks at a worksite:

- It can reduce reduce task complexity and give employees workflow instructions at the moment they need instruction.

- It reduces travel requirements, as information flows easily at any geographical scale. Knowledgeable team members can even provide training and instruction from their homes to on-site junior employees.

- It can help worksite managers get visibility into where safety-related issues that shut down operations are occurring.

In other words, worksite knowledge, safety procedures and best practices aren’t limited by who is on-site.

Even at construction sites, writes Serena Capital Operating Partner Amélie Faure, flows of data give project managers real-time visibility into the progress of a project, general contractors more insight into the work of subcontractors, and subcontractors access to big-picture planning concerns so they can make more informed decisions.

Finally, data lets equipment itself report on any issues it might detect. As an example, Dean Takahashi at VentureBeat spoke to members of the IBM Research team in 2014 for a piece on what the company was working on in the mining industry. One of the technologies IBM helped pioneer were analytics tools that let mining equipment report levels of use.

Think of this as a smart odometer. In real time, a drill or an excavator could relay back whether it was operating under light, normal or strenuous conditions. With this data, the mining company can accurately predict when maintenance would be necessary and seamlessly deliver a new piece or a new machine, rather than risking a shutdown due to equipment failure.

“IBM estimates that its insights could save a $30 billion mining company several billion dollars a year in productivity gains,” Takahashi reported. “That may sound wildly optimistic. But the cost of having an excavator go down in the field is $5 million a day, while the cost of losing a haul truck is $1.8 million per day.”

Images by: photosoup/©123RF Stock Photo, welcomia/©123RF Stock Photo, 1971yes/©123RF Stock Photo